There’s no denying that #BookTok is transforming the way that many Canadians discover books. Even if you don’t have a TikTok account, you’re bound to have noticed the ever-popular displays of #BookTok trending titles at your local bookstore. It’s even influencing book cover designs.

At BookNet, we’re no stranger to #BookTok — we’ve been paying attention to this trend since it started in 2020! And it’s only been growing. When Marketing Associate Nataly Alarcon recorded the podcast Beyond #BookTok: When social media and publishing collide last summer, the hashtag #BookTok had more than 14 billion views. Just over a year later, that number is over 79 billion!

Earlier this year we also hosted two webinars with a panel of BookTokers as part of our Tech Forum series — What makes #BookTokers tick: Everything publishers need to know and What makes #BookTokers tick part two: Even more of what publishers need to know — offering insight into how they recommend books on TikTok, partner with publishers and bookstores, and more.

In our research, we track the influence of social media platforms on Canadian book consumers through our consumer studies. So far, in collecting data for the 2022 edition of our Canadian Book Consumer survey, we found that 21% of all Canadian book buyers are on TikTok, up from 17% in 2021. The number of books purchased by Canadians because of a recommendation or review has also increased, at 17% so far in 2022 and steadily up 44% over the last five years.

TikTok has become a vital discovery tool — for younger users especially. This past summer at Fortune's Brainstorm Tech 2022 conference, Google Senior Vice President Prabhakar Raghavan shared that 40% of young people search for restaurants on TikTok or Instagram, rather than Google Maps or Search.

But here’s the question that’s really on our mind: Is #BookTok responsible for a backlist renaissance?

To find out we used SalesData, the national sales tracking service for the Canadian English-language trade book market, to track the print sales of 20 backlist titles that have trended on #BookTok since it took off in 2020:

Pride and Prejudice by Jane Austen

Cain’s Jawbone by Edward Powys Mathers

Legend by Marie Lu

The Song of Achilles by Madeleine Miller

Shatter Me by Tahereh Mafi

Shadow and Bone by Leigh Bardugo

We Were Liars by E. Lockhart

Red Queen by Victoria Aveyard

All the Bright Places by Jennifer Niven

A Little Life by Hanya Yanagihara

A Court of Thorns and Roses by Sarah J. Maas

It Ends with Us by Colleen Hoover

The Hating Game by Sally Thorne

Girl in Pieces by Kathleen Glasgow

They Both Die At The End by Adam Silvera

The Seven Husbands of Evelyn Hugo by Taylor Jenkins Reid

The Cruel Prince by Holly Black

Heartstopper: Volume 1 by Alice Oseman

The Unhoneymooners by Christina Lauren

Red, White & Royal Blue by Casey McQuiston

Altogether, these titles were associated with 248 ISBNs.

The smallest number of ISBNs related to a single title is two ISBNs.

The largest number of ISBNs related to a single title is 96 ISBNs.

While each title had 12 related ISBNs on average, the median was 8 ISBNs.

Now, the results!

#BookTok books sell

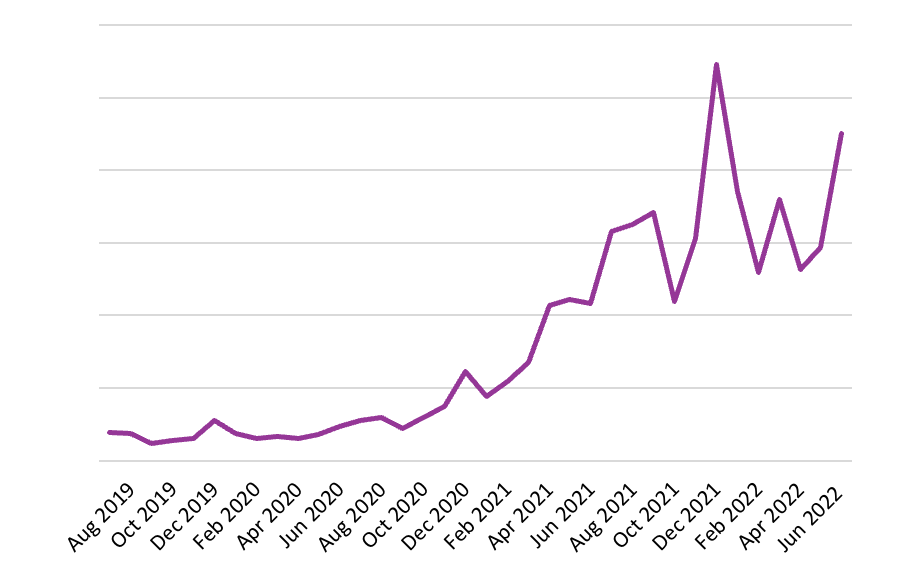

Without a doubt, Canadian book buyers are buying backlist titles that trend on #BookTok. The graph below shows the aggregated sales of each of the 20 titles month-by-month from July 2019 to June 2022. Over this time period, sales for these trending #BookTok titles increased exponentially, up 1,047% overall. From the lowest number of sales in September 2019 to the highest number of sales in December 2021, that’s an increase of 2,166%.

And it’s not just a single title bringing up the percentage. Each and every of the 20 backlist titles on the list saw unprecedented peaks in sales month-to-month, up anywhere from 146% to 235,600%, with a median increase of 2,255%.

Which titles saw the biggest peaks in sales? The top three #BookTok-trending backlist titles with the greatest increases are:

Cain’s Jawbone by Edward Powys Mathers (1939) — up 235,600% from October 2019 to June 2022;

It Ends with Us by Colleen Hoover (2016) — up 42,133% from November 2019 to June 2022; and

Shadow and Bone by Leigh Bardugo (2012) — up 6,769% from September 2019 to May 2021.

Backlist boom

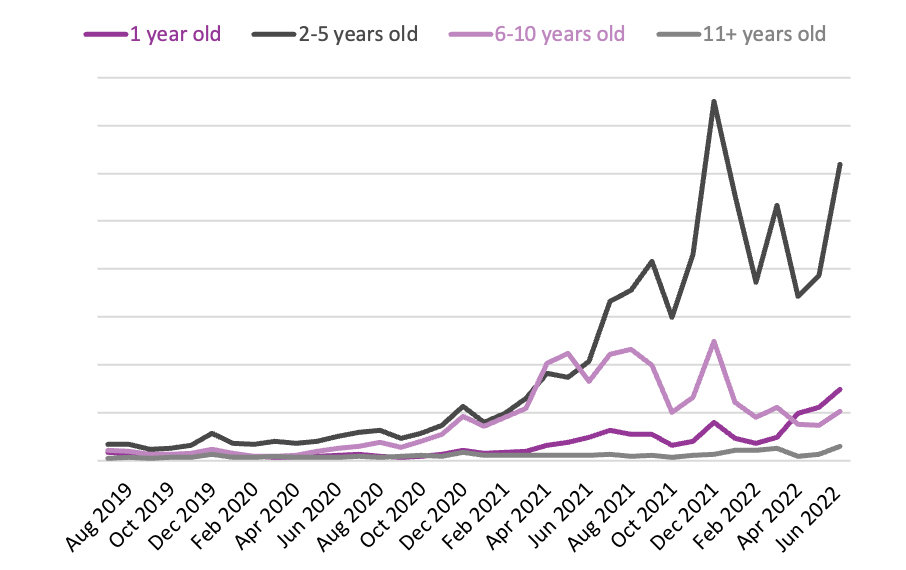

Backlist titles are getting a boost in sales from #BookTok, but as BookNet Canada’s Project Manager Monique Mongeon discovered in her backlist blog series last year, not all backlist titles are created equal. In the entire Canadian book market in 2021, backlist titles that were two to five years old sold the best, followed by titles that were one year old.

For our list of 20 backlist titles:

15% were 1 year old at the start of #BookTok (pub year 2019);

50% were 2-5 years old at the start of #BookTok (pub years 2015-2018);

25% were 6-10 years old at the start of #BookTok (pub years 2011-2014); and

10% were over 11 years old at the start of #BookTok (pub years 1813 and 1939).

The graph below shows the sales of these trending titles according to their age. Here we see that it’s backlist titles that were two to five years old before #BookTok began that sell the most, with an overall increase in sales of 1,698%. Next bestselling are 6-10 years old and 1 year old titles, up 395% and 812% respectively from July 2019 to June 2022. Selling the least in terms of units sold are titles over 11 years old, although they did see an overall increase in sales of 489%.

Trending topics

Which book subjects trend the most on #BookTok? Half of our 20 backlist titles were classified as Adult (or general trade) titles in BISAC, while the other half were Young Adult titles.

The most popular Adult subject was Fiction / Romance, at 50% of all Adult titles. For Young Adult titles, the subjects were more varied, with the top categories tied at 20% each — Young Adult Fiction / Social Themes and Young Adult Fiction / Fantasy.

Despite the Adult and Young Adult being evenly split in terms of the number of titles, Adult titles outsold Young Adult ones, shown in the graph below. Adult backlist titles on #BookTok saw a sales increase of 1,328% from July 2019 to June 2022, while Young Adult titles were up 749% over the same time period.

Titles and series

Does whether or not a title belongs to a book series matter for our #BookTok backlist titles? Out of the 20 backlist titles on our list, 35% belonged to a larger book series, while 65% were standalone titles.

Individual titles also saw a greater number of unit sales compared to series titles, shown in the graph below. Yet, in June 2022 both individual titles and series titles saw an equivalent number of sales. Over the entire time period, individual titles saw a sales increase of 660% compared to series titles' 1,708%.

Curious for more data about the impact of #BookTok on the Canadian book industry? Stay tuned to our blog for the next part of this series, about #BookTok’s impact on Canadian library circulation.

And sign up for the research newsletter for the latest research on the Canadian book market, delivered right to your inbox!

5 questions with Sarah Vasu from Caitlin Press.