Our study, The State of Publishing in Canada is back and available for download.

Focusing on the Canadian English-language publishing sector, the study features data collected from 78 Canadian-based publishers of all sizes, representing approximately 72% of the print book market. This study includes data about the publishing companies' performance during 2021 and offers insights into publishers' operations and staffing; revenue and sales; distribution; format-specific publishing programs; and the impact of the COVID-19 pandemic.

We’ll share some highlights below, but you can download a copy of the study in PDF or EPUB format here!

The State of Publishing in Canada 2021

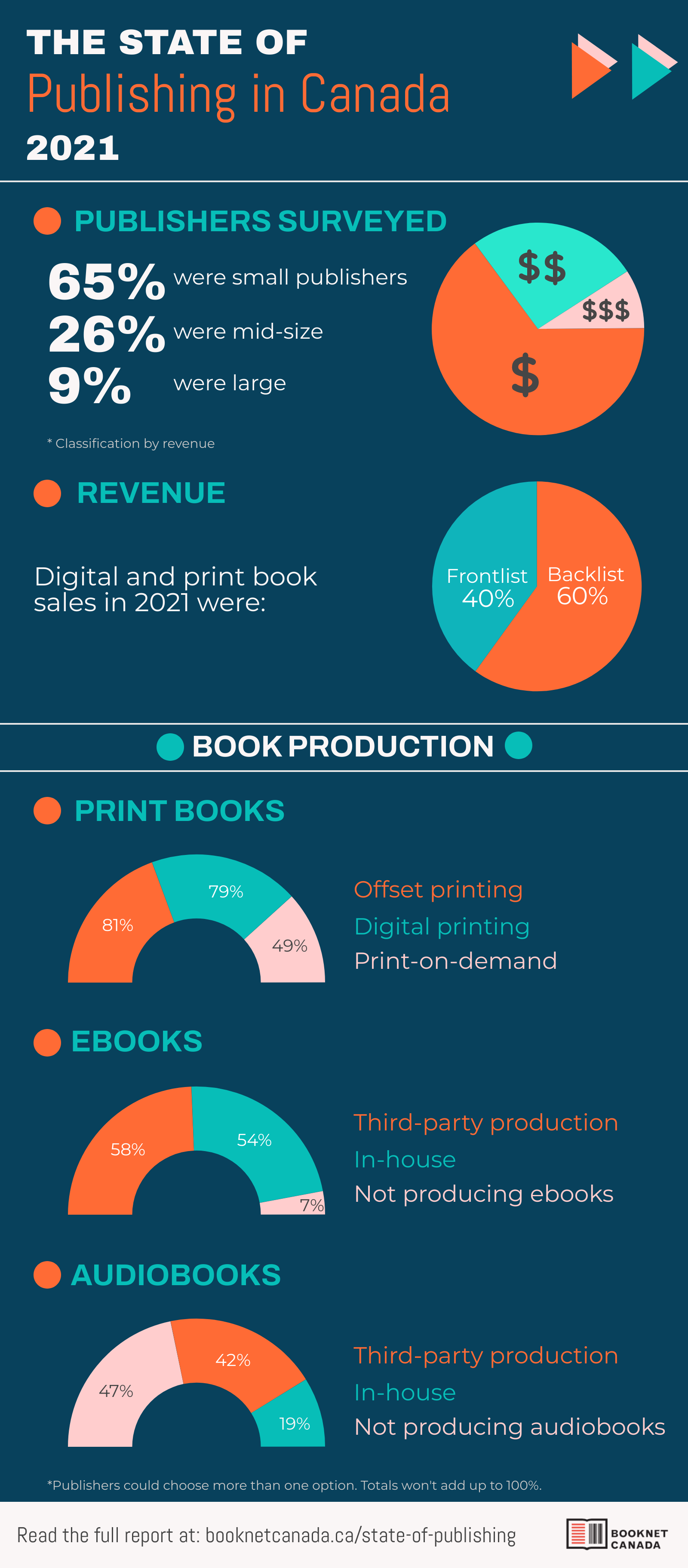

Of the 78 publishers surveyed, 65% of them were small publishers with a gross revenue between $0 and $999,999, 26% were mid-size with gross revenue between $1M and $9,999,999, and 9% were large publishers with revenue higher than $10M.

In 2021, 60% of print and digital sales were backlist and 40% were frontlist titles.

Looking at book production by formats, when it comes to print books, most publishers used offset printing (81%) or digital printing (79%), with 49% of publishers using print-on-demand services.

For ebook production, most publishers used a third party (58%), followed by in-house production (54%). Only 7% of publishers were not producing ebooks.

In the audiobooks space, a large number of publishers said they were not producing audiobooks (47%), 42% were using third-party production companies, and 19% were producing audiobooks in-house.

The world of digital

Overall, 59% of publishers reported seeing increases in digital book revenue in 2021 compared to 2020.

Some of the barriers that kept publishers from starting to publish or publishing more ebooks were time (57%), expertise (29%), and money (29%).

Even though there were challenges around publishing digital books, the majority of publishers surveyed produced audiobooks (53%). Continuing the upward trend that we’ve seen in previous years where the number of publishers making audiobooks has been increasing from 16% in 2015 to 37% in 2016, and 61% in both 2017 and 2019.

Some of the barriers that kept publishers from starting to publish or publishing more audiobooks were money (68%), time (20%), and lack of demand (18%).

Sales & revenue

Looking at changes in revenue, of the 78 publishers that responded to our survey, 55% saw an uptick in revenue in 2021 compared to 2020. On the flip side, 23% of the surveyed publishers reported decreases in revenue, while 14% said their revenue stayed flat.

Interestingly, publishers estimated that 13% of their gross revenue came from sales in international markets. Most publishers who sold to markets outside Canada reported that their revenue from these sales either stayed the same (21%) or increased (18%) from 2020 to 2021.

Canadian spotlight

While publishers of all sizes are working on publishing books by Canadian contributors, small and mid-size publishers are taking the lead by having 96% to 97% of all their published titles include at least one Canadian contributor.

Ready to learn more? In the study we also cover topics such as sustainability, printing methods, shipping, distribution, marketing, and much more — download your free copy today!

Get a free copy of the study in PDF or EPUB format today!