With the movie Demon Slayer: Mugen Train breaking box office records as the highest grossing Japanese film both inside and outside Japan, chances are you’ve watched anime and maybe even read manga.

In the first half of 2021, American-based NPD BookScan reports that sales of comics and graphic novels increased 178.5% over the last year and now occupy nearly 20% of adult fiction sales in 2021, compared to 9% in 2020. The bestselling comics and graphics novels in the American market? Manga titles.

Is manga taking the same hold over the Canadian market?

Like we saw in our 2018 blog post, sales of manga titles in the Canadian market have been trending upwards, increasing 31.8% between 2013 and 2017. And, according to our latest Canadian Leisure & Reading Study 2020, 21% of Canadian adult readers read comics or graphic novels, up from 19% the year prior.

To find out more, we’ve used BNC SalesData to take a look at the sales of manga titles across the board over the last 5 years — from 2016 to 2020 in the general/trade (adult), young adult, and juvenile markets — as well as what’s trending in the Canadian market so far in 2021.

What counts as Manga, anyway?

The easiest definition: manga are comics and graphic novels produced and published in Japan. This is not to be confused with South Korean manhwa and Chinese manhua, which are similar comics and graphic novels produced in their respective countries. Their international marketshare is currently smaller than the manga market, but it’s also growing — a story for another time.

In Japan, they classify manga titles first by audience demographic, then by genre. There are five main demographics:

shōnen, manga for teenage boys,

shōjo, manga for teenage girls,

seinen, manga for adult men,

josei, manga for adult women, and

kodomomuke, manga for young children.

Outside of Japan, manga are classified in different ways. Thema, an international subject category scheme, continues to classify manga according to the same demographics groupings they do in Japan, together with a genre classification. The North American BISAC subject classification scheme groups manga differently.

For BISAC, general/trade (adult) manga are classified as Non-Fiction, under COMICS & GRAPHIC NOVELS / Manga, with 22 different subcategories. Manga titles for young adult and juvenile readers are grouped under their respective Fiction headings, with no further subcategories. Yet, the lines between manga for young adult and general/trade audiences tend to become blurred in BISAC. More often than not, shōnen and shōjo manga are classified under the general/trade manga subject heading, even though they are marketed mainly towards teenagers in Japan.

Here in Canada and across North America, BISAC is the primary subject classification scheme for the publishing industry. And so, for this study, we’ve pulled data for these BISAC subject codes:

CGN004050 – COMICS & GRAPHIC NOVELS / Manga (and subcategories),

YAF010010 – YOUNG ADULT FICTION / Comics & Graphic Novels / Manga, and

JUV008010 – JUVENILE FICTION / Comics & Graphic Novels / Manga.

Classification questions aside — onto the data!

Manga for adults

There’s no denying that manga’s capturing the imagination of Canadian readers.

From 2016 to 2020, the number of new COMICS & GRAPHIC NOVELS / Manga ISBNs published each year in the Canadian market has steadily increased 48%, with 2021’s number on track to top 2020’s figure.

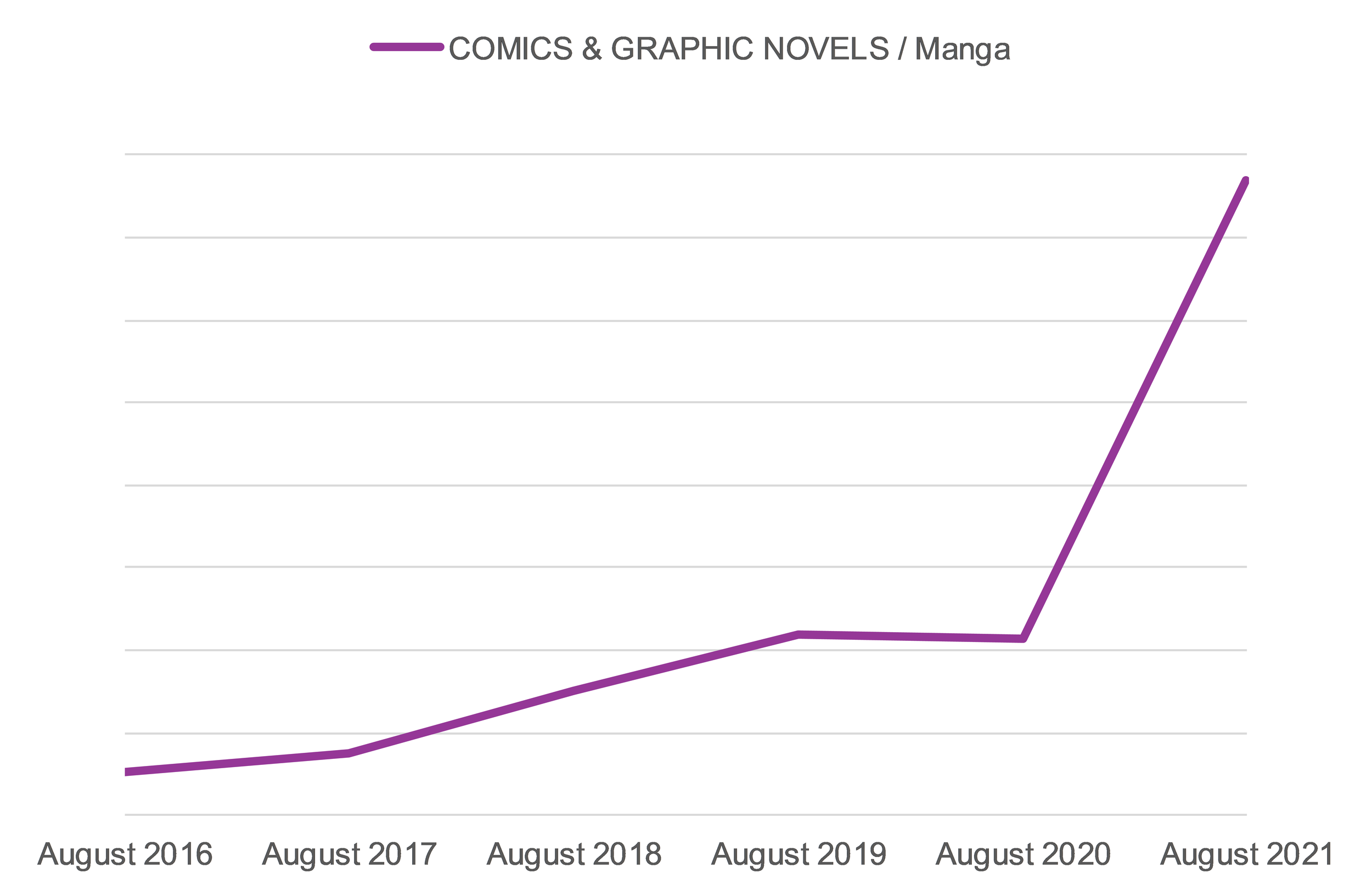

Sales of general/trade manga titles have also been consistently trending up year after year, with an increase in sales of 106% from 2016 to 2020, seen in the graph below. In 2021 so far, the growth of general/trade manga sales has turned exponential. Sales as of August 2021 have already surpassed the total sales for 2020 by 5%, with more to be expected before the end of the year.

When we compare only sales from January to August across these years, we can see just how much of a surge in sales this manga subject category is having. As shown in the graph below, sales of general/trade manga titles have increased 135% from this time last year, with the subject category currently occupying an over 3% marketshare of the total Canadian book market.

Which manga titles are trending for general audiences?

With 22 different subcategories under COMICS & GRAPHIC NOVELS / Manga, there are lots of options for Canadian readers to choose from. As of August 2021, the 5 top selling subcategories are:

Fantasy – 27% of all general/trade manga sales and up 134% overall from this time last year

Action & Adventure – 18% of all general/trade manga sales and up 91% overall from this time last year

Horror – 10% of all general/trade manga sales and up 345% overall from this time last year

Romance – 8% of all general/trade manga sales and up 151% overall from this time last year

Supernatural – 5% of all general/trade manga sales and up 98% overall from this time last year

Compared to August 2020, we’re also seeing huge increases in sales of Isekai, Dystopian, and Crime & Mystery subcategories with rises of 250%, 226%, and 210% respectively.

Based on what’s trending, it should come as no surprise that these are the top 3 bestselling general/trade manga titles so far in 2021:

Uzumaki by Junji Ito (Manga / Supernatural)

My Hero Academia, Vol. 2 by Kohei Horikoshi (Manga / Action & Adventure)

Jujutsu Kaisen, Vol. 1 by Gege Akutami (Manga / Horror)

Like we mentioned earlier, many manga titles that are written for young adult audiences in Japan are classified as general/trade manga in BISAC. While Uzumaki is a title for adults, My Hero Academia and Jujutsu Kaisen are both shōnen manga, geared towards teenage boys.

The ubiquity of manga titles for young adults under the general/trade category isn’t only in the top 3 above. If we take a look back at our 5 top selling subcategories for 2021, shōnen and shōjo manga titles also dominate the bestseller lists. Below, we’ve analyzed the 10 bestselling manga for each subcategory by their Japanese audience demographic:

Fantasy – 100% young adult (shōnen)

Action & Adventure – 90% young adult (shōnen) and 10% adult (seinen)

Horror – 90% young adult (shōnen) and 10% adult (seinen)

Romance – 60% adult (josei and seinen) and 50% young adult (shōjo and shōnen) Note: One title in this top 10 is marketed in Japan as both shōjo and seinen.

Supernatural – 60% adult (seinen) and 40% young adult (shōnen and shōjo)

Manga for young adults

If so many shōnen and shōjo manga titles are found under the general/trade subject heading in BISAC, what does it mean for the Young Adult market in Canada?

Unsurprisingly, the number of manga classified under YOUNG ADULT FICTION / Comics & Graphic Novels / Manga in BISAC is very small. This market is so small, in fact, that no new IBSNs for this subject heading have been published yet in 2021, following single-digit and nought publication numbers in recent years.

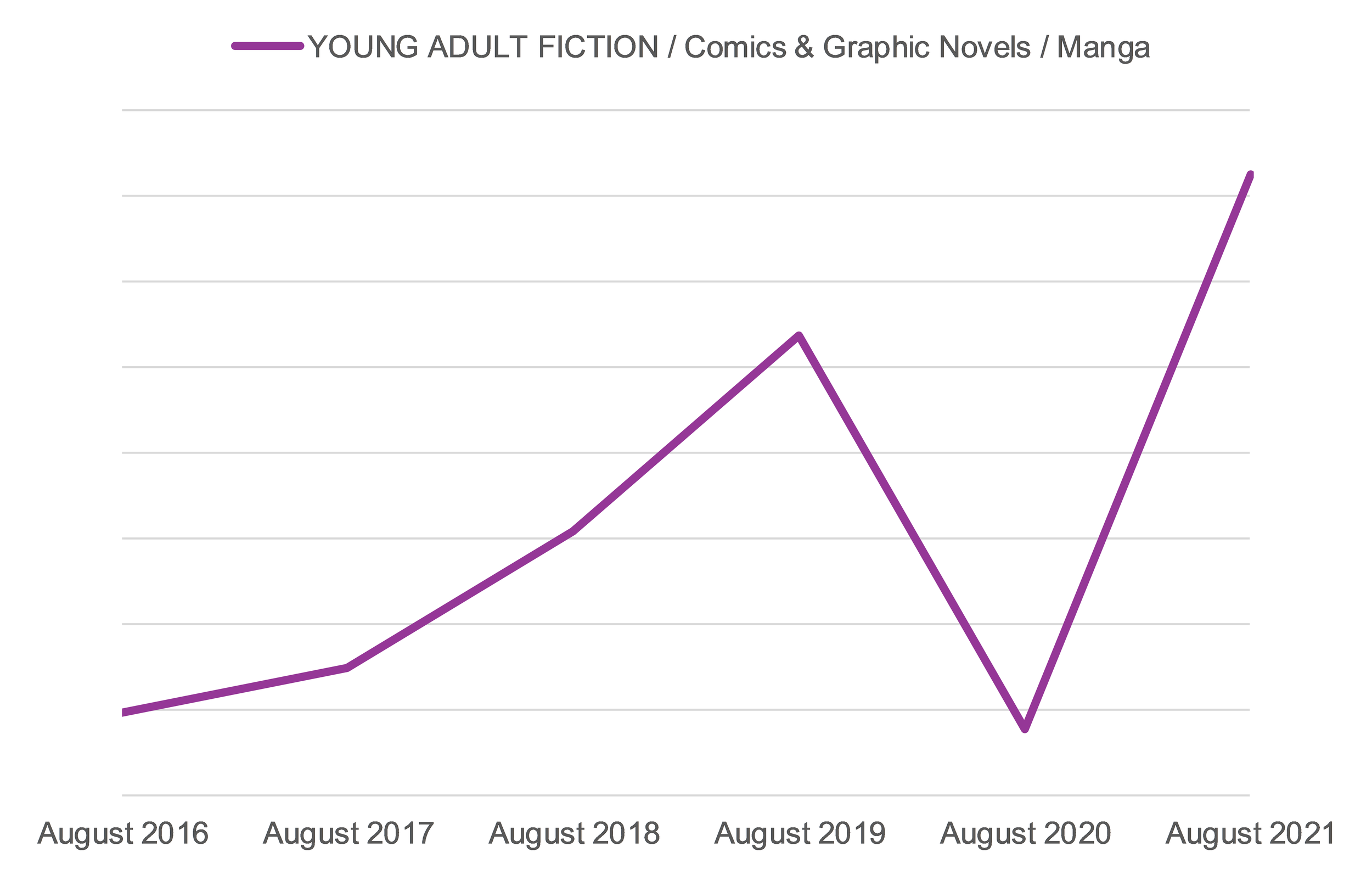

That being said, the market for Young Adult manga titles is slowly growing. As shown in the graph below, sales of this subject category increased 161% from 2016 to 2019, then sunk 52% from 2019 to 2020. Even with the decrease last year, sales of Young Adult manga titles over all 5 years have increased 26%. And it’s continuing to increase. As of August 2021, this year’s sales of Young Adult manga have well surpassed 2020’s total sales by 70%, with more to come before the year is out.

By looking only at the sales of Young Adult manga titles from January to August for each year, we can see 2021’s upwards trend in more detail. In 2021 so far, Young Adult manga sales have reached new heights with a 363% increase over August last year, shown in the graph below. But even with this big increase, the total marketshare of Young Adult manga titles remains at 0%.

Which Young Adult manga titles are the most popular?

So far in 2021, these are the top 3 bestselling manga for Canadian Young Adult readers:

Anne of Green Gables by Crystal Chan & Lucy Maud Montgomery

How to Treat Magical Beasts: Mine and Master's Medical Journal, Vol. 1 by Kaziya

Satoko and Nada, Vol. 1 by Yupechika

Manga for children

The market for Juvenile manga titles is significantly bigger than its Young Adult counterpart and historically more popular.

The number of new JUVENILE FICTION / Comics & Graphic Novels / Manga ISBNs grew 91% from 2016 to 2019. And, even though there was a decrease in new publications of Juvenile manga titles last year, the number of new 2021 ISBNs has already matched the 2020 figure, with more releases to be expected.

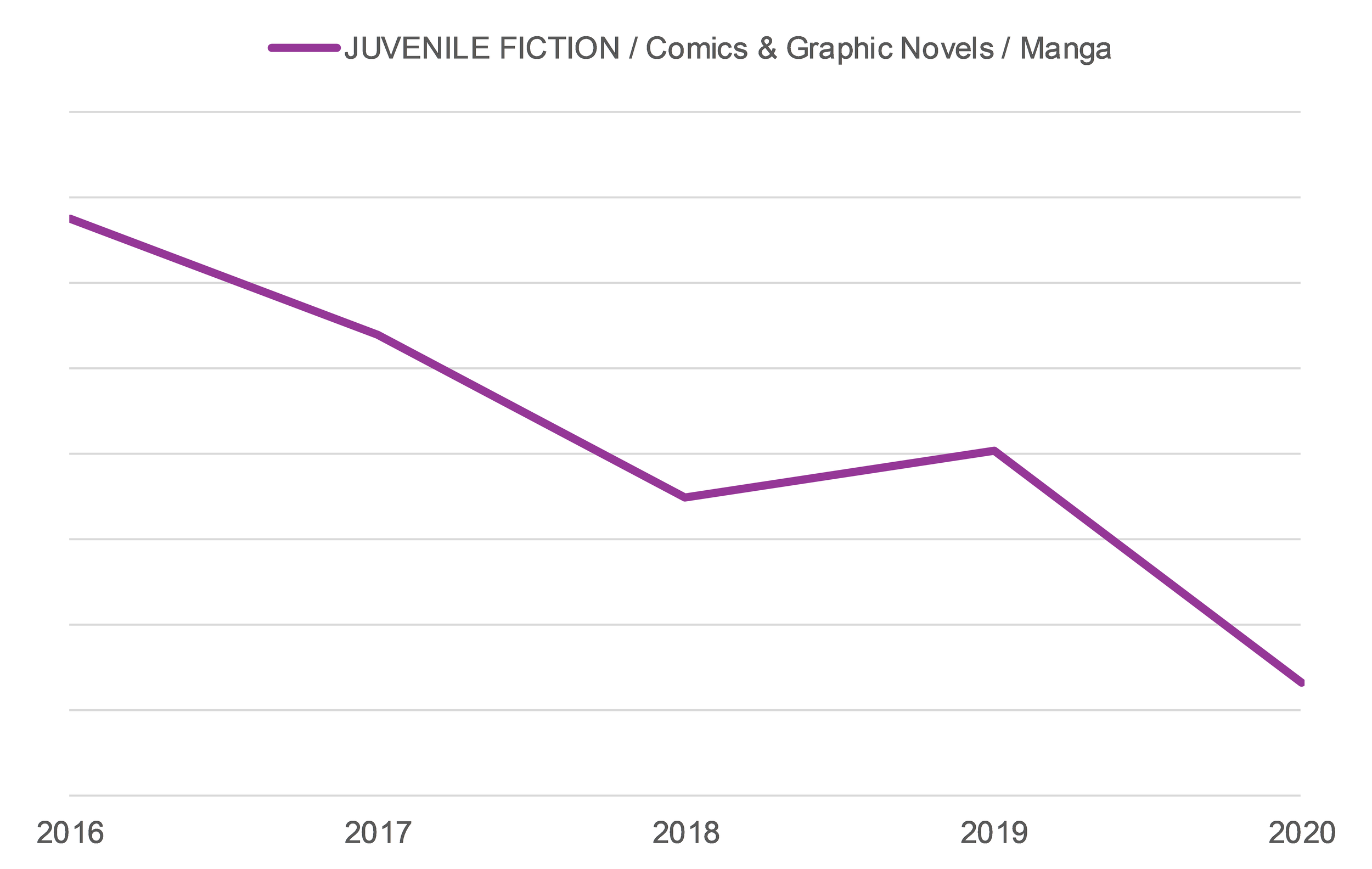

While the number of new ISBNs has been increasing year over year, the sales of Juvenile manga titles have not. In fact, sales of Juvenile manga titles have decreased 62% from 2016 to 2020, as shown in the graph below. Unlike the 2021 sales performance of general/trade (adult) and Young Adult manga titles, Juvenile manga sales for 2021 remain 19% under 2020’s yearly sales for now.

But this doesn’t mean that 2021 sales of Juvenile manga titles aren’t outperforming 2020. The graph below compares the sales of Juvenile manga titles from January to August across each year and shows the upward trend of Juvenile manga sales in 2021 so far. As of August 2021, Juvenile manga sales have increased 67% over sales for 2020 and the subject category currently holds a 0.05% marketshare.

Which manga titles are the top Juvenile picks?

For Canadian Juvenile readers, these are the top 3 bestselling manga titles in 2021 so far:

Warriors: Graystripe's Adventure by Erin Hunter, illus. by James L. Barry

Warriors: Ravenpaw's Path by Erin Hunter, illus. by James L. Barry

Warriors: SkyClan and the Stranger by Erin Hunter, illus. by James L. Barry

Interestingly, the top 3 titles above are not actually manga titles by the traditional definition. They’re original English-language manga based on the Warriors novel series. After Warriors, the next bestselling Juvenile manga in Canada are all Japanese Pokémon titles.

Manga mania?

Mostly!

While the Young Adult and Juvenile manga markets seem less popular, there’s no question that the general/trade manga subject category is on a roll in 2021 after steady gains over the past 5 years. And with sales of general/trade, Young Adult, and Juvenile manga titles all on the rise this year, the train doesn’t seem to be stopping any time soon.

Insights into the latest updates and additions made to ONIX codelists.