A while ago we examined what Canadians were borrowing from the library around the time that physical distancing measures came into effect across the country, and this week we’re going to dive in to how the bestselling titles have changed over the last few weeks. Are readers still buying what they normally buy, or have they started buying differently? We dug into the data to find out.

Overall across the market, the market share of Juvenile titles is up nearly 8% between the pre– and post–physical distancing periods. Juvenile title sales are also up 8% over the same period last year. The market share of Young Adult titles remains flat year over year, so this change in market share is reflected in a reduction in the market share of Non-Fiction (down approx. 6%) and Fiction titles (down approx. 2%).

Alongside these changes in market share, we’ve compared the three weeks since physical distancing measures began (March 16, 2020 to April 5, 2020) to the three prior weeks (February 24, 2020 to March 15, 2020) and dug into rank changes between pre- and post-physical distancing periods in top-level subjects (Fiction, Non-Fiction, Juvenile, and Young Adult).

While the top 100 titles in a given subject tend to be dominated by newer releases, sales tracked in BNC SalesData show some subjects with significant numbers of backlist titles entering (or re-entering) the top 100 in the post-physical distancing period. (We considered books published prior to January 1, 2020 to be backlist.)

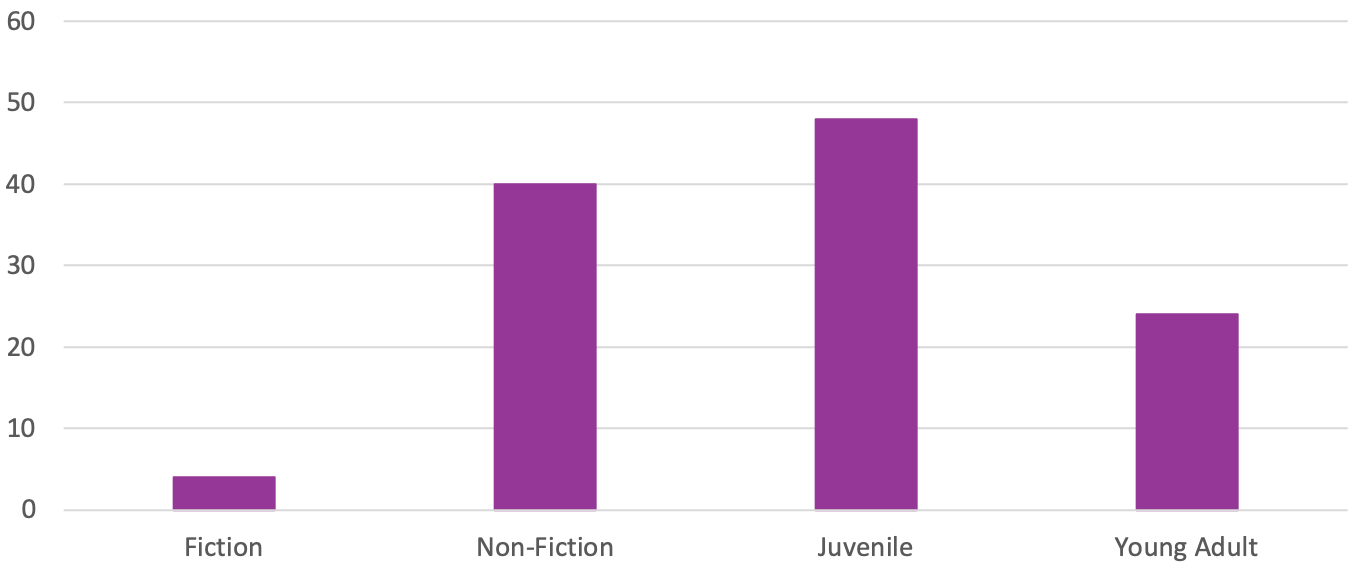

Number of backlist titles re-entering the top 100 during physical distancing, by subject

The Fiction top 100 only had four backlist titles change rank into the top 100 — all previous bestsellers — so it seems like fiction readers' buying habits have remained steadfast despite all the changes happening around them.

However, Non-Fiction experienced a more significant shift toward backlist, with 40 titles joining the top 100, many over two years old. The bulk of these titles were educational in nature: activity books, education titles (particularly around French-language learning), and, in a throwback to 2015/16’s hottest trend, a resurgence of colouring books as well.

The Juvenile top 100 showed the most significant shift, with 48 backlist titles entering the top 100. Nearly all of these titles were Juvenile Non-Fiction, mainly in the study aids and activity books categories. In our previous post on Juvenile Activity Books, we mentioned that there is typically a bump in this category in March, however sales of Juvenile Activity Books in March 2020 were substantially higher than March 2019.

Backlist entrants to the Young Adult top 100 stand at 24 titles, and nearly all are Fiction titles — mainly series titles, box sets, and media-tie-ins. Young Adult is the only subject area where the majority of new top 100 titles are works of Fiction.

If you’re a SalesData & LibraryData subscriber, you can dig into the data yourself by logging in and checking out the Market Share and Trend Analysis reports to track changes in subject sales over time. If not, stay tuned to our blog for more insights on book buyers and borrowers from coast to coast, and let us know which subjects you’re interested in learning more about!

Insights into the latest updates and additions made to ONIX codelists.