Who wasn’t in love with activity books as a child? Books you can write in, build things from, or that help you create works of art. As part of our study, Sales Trends in Children’s Publishing (available exclusively to SalesData subscribers in the Research Portal), we find that the Activity Book genre is one of the most consistently top-selling Juvenile Non-Fiction categories when looking at data for the past three years.

SalesData, which tracks approximately 85% of the print trade market in Canada, reported just under $10 million in sales (according to list price) in this genre for 2019.

In the Activity Book genre, the top sellers are sticker books, stencilling, and nail art. Another type of book that appears a number of times at the top, for both 2018 and 2019, are the pre-kindergarten “wipe-clean” books.

Titles tend to have a lot of staying power; the category is fairly backlist heavy with only two of the top 10 books for 2019 being published in 2019. Seven of the titles were published before 2018 with one title dating back to 2008.

Sales trends

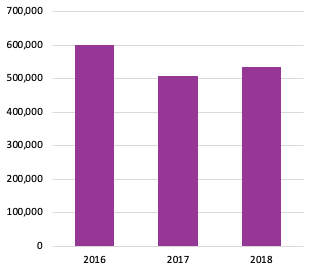

The Activity Books genre has seen some fluctuation over the past three years. In 2016, it saw some increase due to a handful of LEGO® titles that topped the list that year. While the LEGO® activity books continue to sell well, within the Activity Book genre we are not seeing the same volume experienced in 2016.

Annual sales performance – Activity Books – Comparable stores

Looking at the genre’s monthly sales performance, we find a notable sales increase in March, perhaps fuelled by the need to keeps kids occupied over the March break. Summer sees a bit of an increase and winter holiday sales are concentrated in late November to December.

Monthly sales performance – Activity Books – Comparable stores

If you're a SalesData subscriber, you can find a complimentary copy of the entire study in the Research Portal. If you’re not, you can see two more trends from this report in our blog posts: Juvenile genre spotlight: Humorous Stories and Juvenile genre spotlight: Science Fiction.

Sales and library circulation data of Body, Mind & Spirit titles during the the first quarter of 2025.