According to the Canadian Book Consumer Study 2022, 18% of all Canadians we surveyed were book buyers, meaning they bought a new book in a given month in 2022.

Of those book buyers, across all book formats:

Over half of Canadian book buyers bought one book — 56% of print book buyers, 51% of ebook buyers, and 58% of audiobook buyers.

Almost a quarter bought two books — 23% of print book buyers, 24% of ebook buyers, and 22% of audiobook buyers.

Nearly 10% bought three books — 10% of print book buyers, 9% of ebook buyers, and 9% of audiobook buyers.

But what about the “super” book buyers who bought four books or more?

In this blog post, we’re going to be exploring this group of book buyers — those who bought four or more books in a month (one or more books a week!) in 2022 — bringing you unreleased results from the Canadian Book Consumer Study 2022.

Let’s get started!

What they’re buying

Overall, 13% of all Canadian book buyers we surveyed in 2022 were super book buyers.

And out of these super book buyers, 63% bought four or more print books, 54% bought four or more ebooks, and 31% bought four or more audiobooks.

Super book buyers were more likely than all book buyers to buy Fiction titles — 70% of all super book buyer purchases, compared to 61% of all purchases in 2022. This is especially true for print and ebook super buyers, at 70% and 74% of purchases respectively.

In contrast, audiobook super book buyers bought more Non-Fiction titles than all book buyers and super book buyers — 46% of audiobook buyer purchases, compared to 39% of all purchases and 30% of all super book buyer purchases last year.

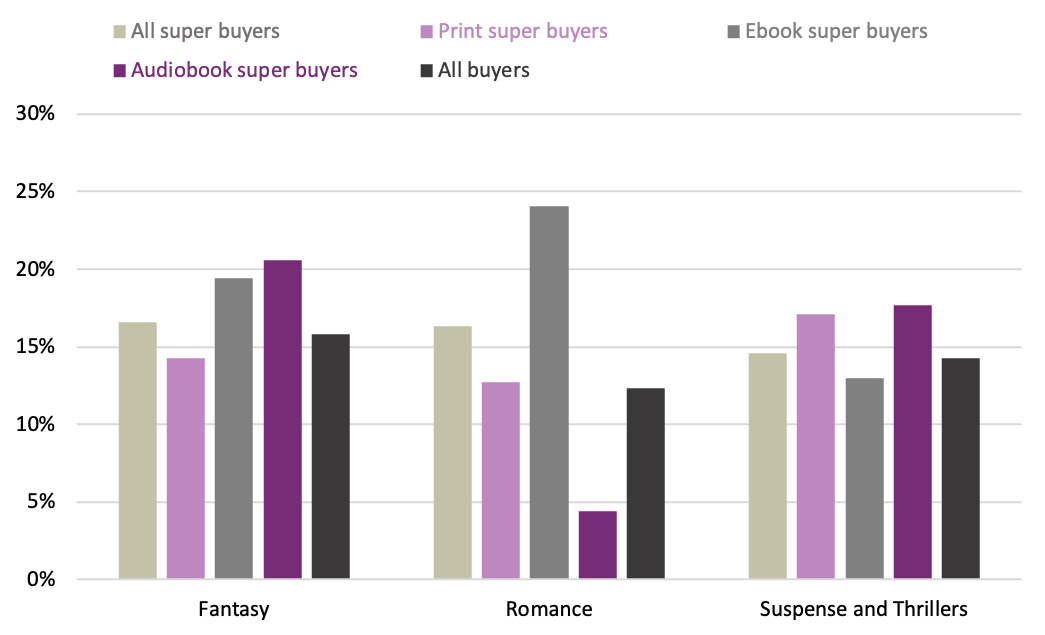

The most popular Fiction subjects among super book buyers varied slightly from the top subjects for all book buyers:

Fantasy — 17% of all super book buyer purchases vs. 16% of all purchases;

Romance — 16% of all super book buyer purchases vs. 12% of all purchases; and

Suspense and Thriller — 15% of all super book buyer purchases vs. 14% of all purchases.

Most significantly, Fantasy titles accounted for 21% of all audiobook super book buyer purchases, Romance titles were 24% of all ebook super book buyer purchases, and Suspense and Thriller titles represented 17% and 18% of print and audiobook super book buyer purchases, respectively, shown in the graph below.

In terms of Non-Fiction subjects, the most popular among super book buyers were:

Self-Help — 22% of all super book buyer purchases vs. 17% of all purchases;

Biography or Memoir — 18% of all super book buyer purchases vs. 22% of all purchases; and

History — 15% of all super book buyer purchases vs. 13% of all purchases.

It’s worth noting that 32% of ebook and and 31% of audiobook super book buyer purchases were Self-Help titles. History titles accounted for 19% each of print and audiobook super book buyer purchases, shown in the graph below.

Where they’re buying

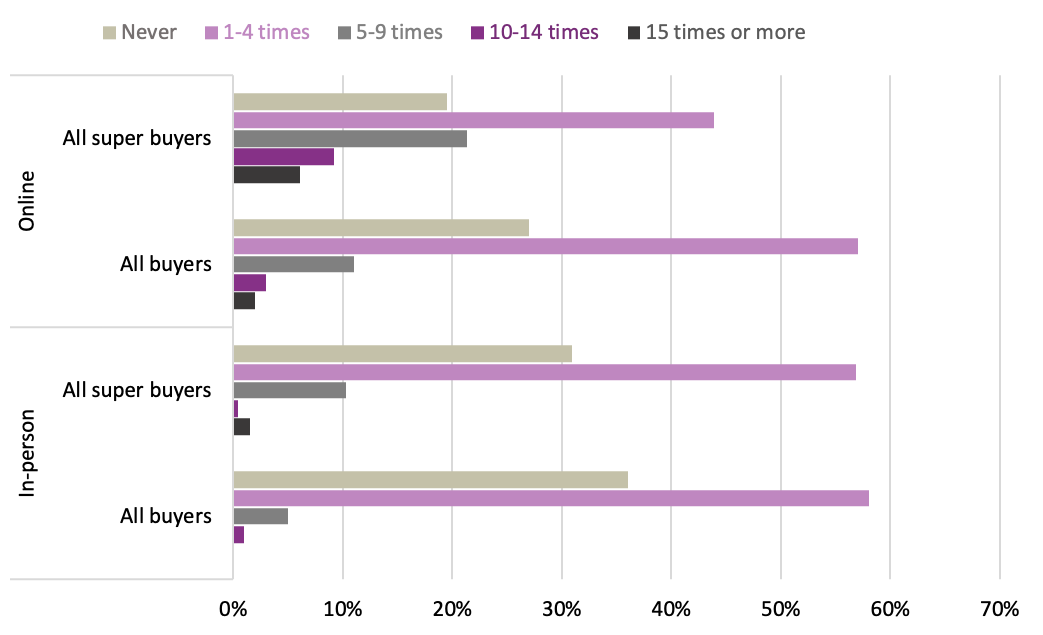

Super book buyers were more likely than all book buyers to visit a bookstore either online or in-person in 2022.

Altogether, 69% of super book buyers visited a bookstore in person at least once in 2022, compared to 64% of all book buyers. And 81% of super book buyers visited a bookstore online one or more times last year, compared to 73% of all book buyers, shown in the graph below.

Super book buyers also bought more books online than all book buyers — 63% bought online and 37% bought in person, compared to 58% of all book buyers who bought online and 42% who bought in person.

When visiting a bookstore in person, super book buyers were slightly more likely to:

Buy a gift — 28% of super book buyers vs. 23% of all buyers;

Browse displays and shelves for books to buy — 33% of super book buyers vs. 31% of all buyers; or

Buy or order specific book(s)/material(s) — 17% of super book buyers vs. 15% of all buyers.

Interestingly, super book buyers were less likely to visit a bookstore to browse new releases — 22% of super book buyers, compared to 28% of all buyers.

When visiting a bookstore online, super book buyers were slightly more likely to:

Check/compare prices — 32% of super book buyers vs. 27% of all buyers;

Buy or order specific book(s)/material(s) — 25% of super book buyers vs. 20% of all buyers; or

Browse books to pass the time — 28% of super book buyers vs. 26% of all buyers.

Why they’re buying

With many visiting bookstores and buying books online, the online shopping experience matters to super book buyers.

Super book buyers were slightly more likely than all book buyers to shop at stores that were:

Easy to navigate — 22% of super book buyers vs. 18% of all buyers;

Had a loyalty card/account/subscription — 15% of super book buyers vs. 13% of all buyers; or

Offered cheap/free delivery — 20% of super book buyers vs. 19% of all buyers.

Having cheap or free delivery mattered especially to ebook super buyers, at 24%.

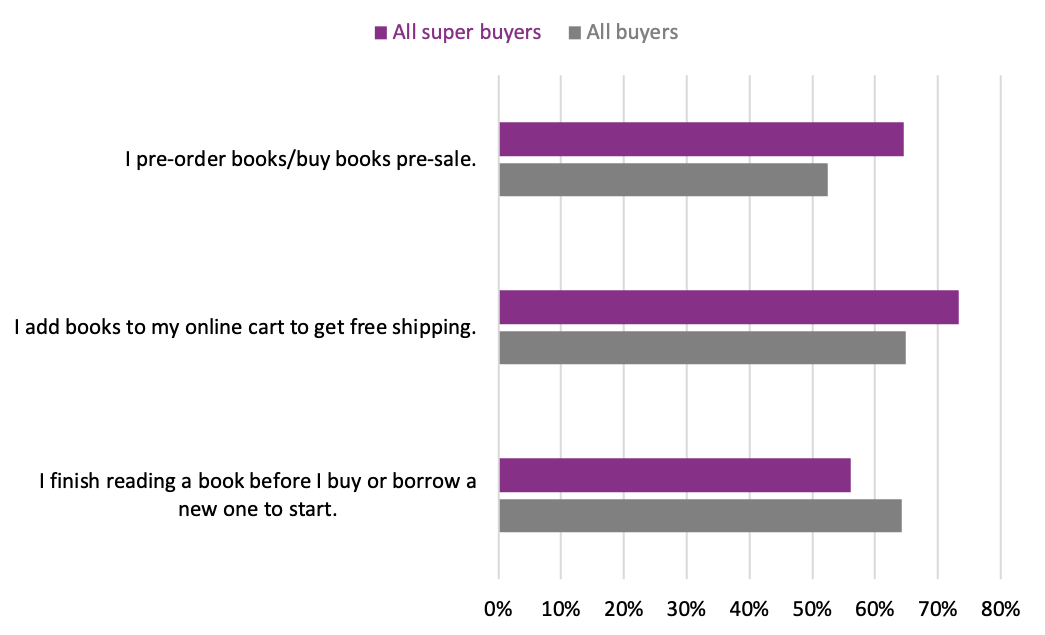

Overall, super book buyers were also more likely than all book buyers to agree with the statements:

“I pre-order books/buy books pre-sale” — 65% of super book buyers vs. 52% of all buyers; and

“I add books to my online cart to get free shipping” — 73% of super book buyers vs. 65% of all buyers.

They were also less likely to agree with the statement “I finish reading a book before I buy or borrow a new one to start,” at 56% of super book buyers compared to 64% of all buyers, shown in the graph below.

Super book buyers chose the books they bought for a variety of reasons, but were more likely than all book buyers to buy a book because:

The library doesn't have it — 14% of super book buyers vs. 11% of all buyers;

It was a low price/on special offer — 17% of super book buyers vs. 15% of all buyers; or

It was requested, or being given, as a gift — 12% of super book buyers vs. 10% of all buyers.

It follows that super book buyers bought more books as gifts than all book buyers. Altogether, 22% of super book buyer purchases were gifts in 2022, compared to 18% of all purchases. This is especially true of print super book buyer purchases, at 28%.

How much they’re spending

It should come as no surprise that super book buyers spent more money on books per month in 2022 than all Canadian book buyers.

While 64% of all book buyers spent $1-49 on books in a given month, only 26% of super book buyers did so. As for the other super book buyers, 23% spent $50-99, 24% spent $100-149, 9% spent $150-199, 5% spent $200-249, and 8% spent $250 or more, shown in the graph below.

Even though they’re spending more overall, super book buyers are slightly less likely to pay full price for their books than all book buyers — 51% of super book buyers' purchases were full price 2022, compared to 55% of all book purchases.

Super book buyers were also notably more likely to participate in a book-related rewards or loyalty program — 78% of super book buyers, compared to 66% of all book buyers in 2022.

But what’s for certain is that super book buyers love books. Half of all super book buyers rate the value for money they spent on books in 2022 as excellent, which is higher than the 46% of all book buyers who did so.

That’s a wrap on super book buyers!

Want more data on Canadian book consumers? Stay tuned for the next instalment of this blog series, where we delve into the lives of super book borrowers.

In the meantime, check out the Canadian Book Consumer Study 2022 or our newly released Canadian Leisure & Reading Study 2022 for the latest on Canadian book buyers, borrowers, and readers.

Keep your eyes peeled on our blog and sign up for the research newsletter so you’re always in the know.

The latest news out of the European Commission.