2015 was an interesting year for the book market in Canada. After a few consecutive years of declining print book sales, the market saw a slight rebound in 2015: print book sales were up 0.8% in units sold and 1.6% in value when comparing 2015 to 2014 in our book sales reporting service, BNC SalesData. We captured some of the data available in this infographic, or you can check out The Canadian Book Market 2015 to see the full story,but let's have a look at some of our other 2015 data that hasn't been captured elsewhere. This data comes to us primarily from our consumer surveys, which we did quarterly throughout 2015.

Formats

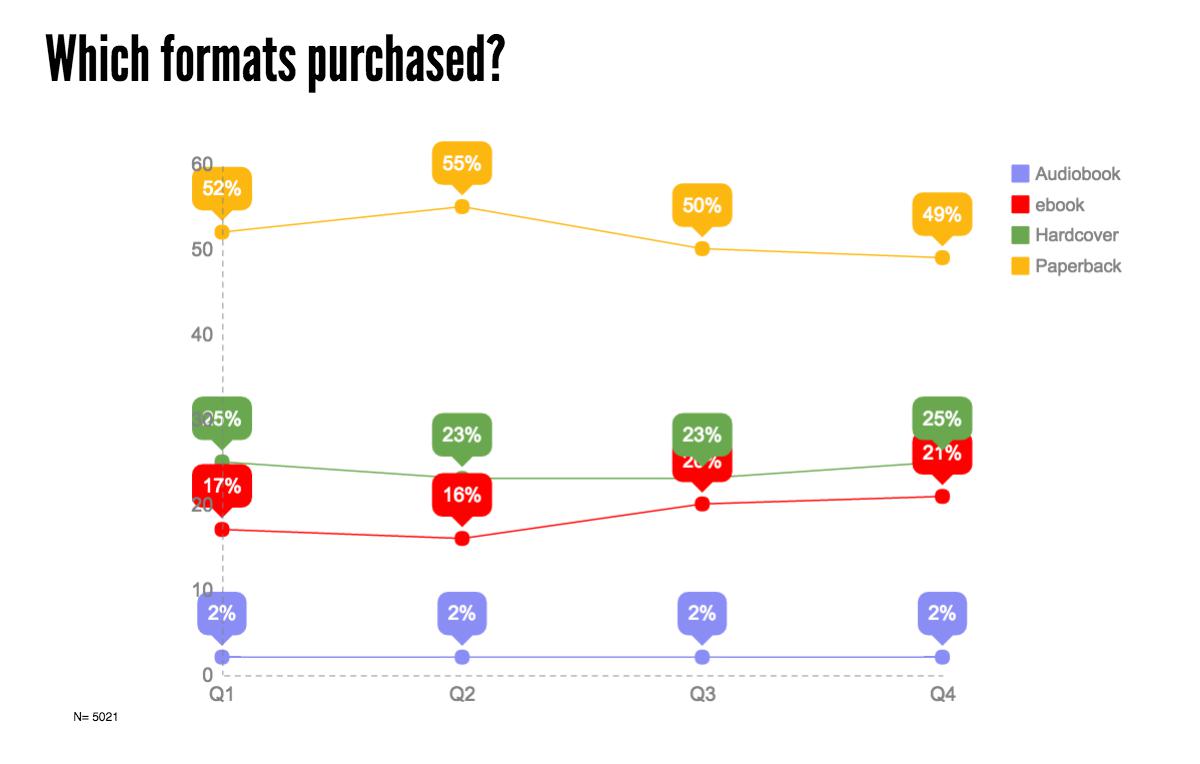

The big story for 2015, across many markets, was that ebook sales were down in year-over-year comparisons (The New York Times and The Telegraph both reported on this), but there's more to that story. Much of the downward trajectory appears to be from "traditionally" published titles, while overall ebook numbers are actually flat or up very slightly. This is according to consumer surveying of our Canadian book-buying panel when comparing 2013 to 2015. It may be that ebook sales went up significantly in 2014 (a year we do not have data for) and then declined in 2015, but it seems unlikely. The overall numbers in 2015 indicate only a slight increase over 2013 and it's within the margin of error, but the numbers definitely are not showing a precipitous decline in ebook marketshare.

- In 2013, 17% of books purchased by the panel were in ebook format (n= 11918).

- In 2015, 19% of books purchased by the panel were in ebook format (n=5021).

There was a slight uptick in the percentage of ebooks purchased in both Q3 and Q4 of 2015, which was a phenomenon we haven't seen before, and will watch going forward in 2016. It also appears there may be a negative correlation between the percentage of ebooks purchased versus paperbacks.

Store Type

As part of our consumer surveying, we also asked book buyers where, when, and why they purchase the books they do. Focusing on the where for a moment, we can really see the importance of online purchasing for books and book-like content. In 2015, 46% of all books purchased by our respondents, in any format, were purchased online or in an app. We have included the 2013 numbers here for interest only as our surveying changed in 2015 (to more accurately capture the stores where the purchase occurred) so year-over-year comparisons are not accurate.

Awareness

It can be hard to know exactly why a specific person buys a specific book. It's very unlikely that a single factor of discovery or awareness leads to a sale, but results instead from varied sources that push a person to buy one book over another. In our survey, respondents could select multiple choices from a long list of ways they became aware of each of their book purchases. When we looked at the overall numbers for 2015, the top three awareness factors leading to purchase were:

- From reading other books by author/in-series

- Saw while browsing/searching in shop/online/elsewhere

- Recommendations or reviews

*Note: Factors 1 & 2 are separated by less than 0.1%

These deliberately vague, umbrella statements allow us to ask more in-depth follow-up questions. For example, below the option "Saw while browsing/searching in shop/online/elsewhere" the single highest awareness factor is in-store browsing (44%). That being said, when "in-store browsing" is combined with the other physical awareness factors (e.g., word-of-mouth), they're just about equal to the online factors (e.g., social media).

Let's have a look at online browsing, specifically:

By far, the most important online browsing experience that leads to purchase is the bookseller website. If you're browsing an online bookstore, there's a pretty good chance that you may end buying a book there as well. With most of the other online browsing options, there is either a much smaller selection of titles, or perhaps no retail site attached to allow consumers to buy through, which likely helps build awareness in titles that could result in future sales, but doesn't translate directly to an immediate sale as with a bookseller website.

We're always excited when the data is telling us an unexpected story. Rather than the demise of the ebook and the triumph of print, we could be witnessing the stabilization of publishing. With more data on where, when, and why consumers are purchasing titles, we can begin to understand how consumers become aware of new titles, and use that discoverability data to aid publishers and retailers. It's too early to call any trends for 2016, but we certainly have some interesting developments to watch.