In many English-speaking countries, the most well-known e-reading devices are from giant brands such as Amazon, Google, or Apple. But the Canadian market paints a slightly different picture. According to the results of our consumer research in the first half of 2012, we found that, when asked which devices consumers planned to use to read their e-books, Kobo was the market share leader at 27%, followed by Kindle at 19% and the iPad at 14%. But let’s see if these preferences spill over into the online arena and how Canadians are using Google to search for their next e-book or e-reading device.

Broad Trends

The e-book market is a relatively new frontier, and given that it’s a digital one, let’s see what happens when consumers take to the internet to shop and search. With very little work it’s easy to see exactly who and what Canadians are looking for. A quick glance at Google Trends shows us that Canadians are frequently searching for Kobo, more so than rival Kindle. I performed a Google Trend search that spanned the last 90 days (until February 4, 2013), using the search terms “Kobo” and “Kindle”, and limiting the results to searches made in Canada.

(You’re wondering: “But what about the iPad?” I also searched for “iPad” and “Apple,” but the results eclipsed both Kobo and Kindle, and given what we know about what Canadians use to read e-books and that iPads aren’t primarily associated with e-books, I didn’t focus my analysis there.)

Both search terms produced nearly identical patterns, but there was a clear winner in terms of search volume.

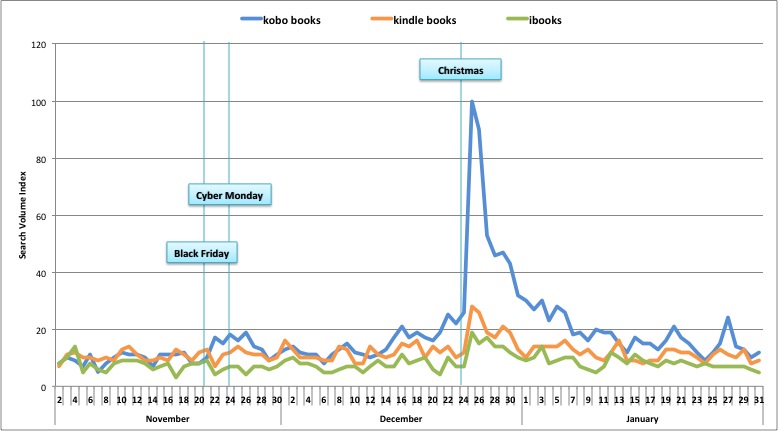

Note the spikes for Kobo on Black Friday and Cyber Monday. Based on numbers from over 500 US online retailers, Cyber Monday was record-breaking in 2012, with sales hitting an estimated $1.5 billion. Kobo was prepared to capitalize on this spending in Canada. On November 23rd and 26th Kobo offered up their latest product, the Kobo Mini, for the reduced price of $49, marked down from $79. Kobo also offered sales on the 26th, with coupons for savings up to 80% off on select e-book titles. Press releases for these sales could be found on several different online sites and blogs, which seemed to combine and improve upon the success that Kobo has through Google Search.

Kindle also offered similar promotions for Cyber Monday, marking down the Kindle Fire 8GB to $129 (a discount of $30), and offering up to 80% off select titles. But the deals were only handled through Amazon.com, which isn’t targeting the Canadian market.

Related Search Terms

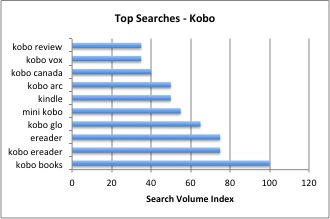

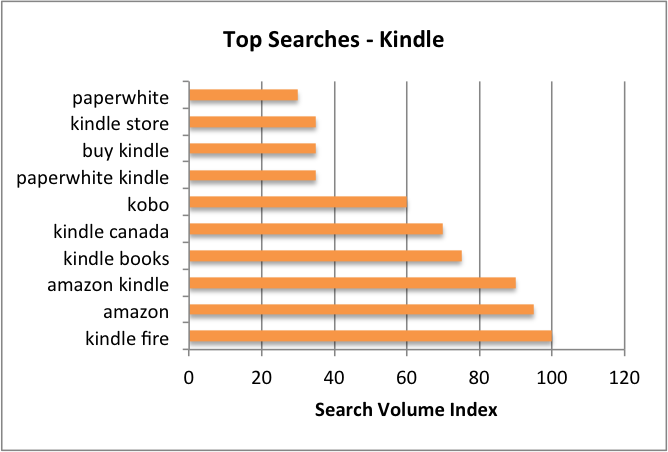

What’s also interesting to examine are the related search terms that people use to research and locate both Kobo and Kindle. Google trends measures Top Searches as those terms that have received the highest levels of interest in relation to the original search terms being measured, in this case Kobo and Kindle. For both brands, the top ten related search words are related to their devices, such as the Paperwhite or Kobo Glo.

|

|

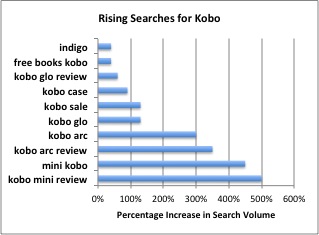

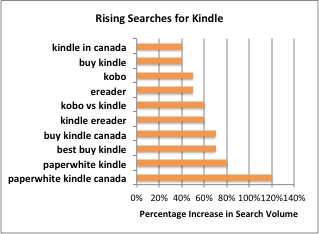

It’s also important to look at the rising search terms. These are the terms whose frequency has been increasing over the same time period. In this case, Kobo’s rising search terms are significantly higher than Kindle’s. “Kobo mini review” saw a 500% increase in search volume, followed closely by “mini kobo,” which saw an approximately 450% increase in searches. Searches for reviews, product comparisons and places to purchase devices should indicate an intention to buy, and if these numbers are any indication, Kobo is way ahead.

|

|

E-Bookstore Searches

While it’s good to look at how the Kobo and Kindle brands compete in the Google search boxing ring, we shouldn’t lose sight of the fact that their devices are used to move other products, namely e-books. So next I wanted to look at how Canadians are searching for e-bookstores.

I included iBooks in the mix this time to round things out. Again, I saw the same frontrunner. You’ll notice that the three terms have similar patterns here too.

Related and rising search terms for “Kobo Books” and “Kindle Books” can be found in the graph below, and again you will find that Kobo is outperforming Kindle when it comes to who Canadian consumers are looking for online.

Not only did Kobo have more rising search terms with higher percentages of growth, but it also had two terms with breakout results, which indicates that these terms have experienced an increase of over 5,000%.

Part of the success Kobo has had over Kindle in this Google Trends war might have something to do with their SEO and Google Adwords campaigns. SEO and online ads are measured in real time, and search queries can produce different results over the course of an afternoon. That being said, after testing this theory out over the span of a week, I found that Kobo was consistently outbidding Kindle for Google ad space, and more importantly outperforming Kindle in organic search results for e-books and e-readers.

When I type “e-reader” into Google, the results include Kindle- and Kobo-sponsored ads. During the week of January 4th to January 8th, Kobo unfailingly landed on the first page, linking to their website or to the Indigo website promoting Kobo devices. Similar results were produced when I changed my search term to “e-books.” Only Kobo consistently crowded the first page of organic search results.

Looking Ahead

In December, Amazon.ca began offering select Kindle devices and a large portion of the e-book selection that until now was only available from Amazon.com. What this means for the Canadian a consumer is the opportunity to purchase e-books and e-readers in Canadian currency and receive similar shipping discounts that our American counterparts have received from Amazon.com.

While this search analysis would seem to show that Kobo is in the lead, this is no time for them to get comfortable. It will be interesting to see how these search trends change as more Canadians become aware of Amazon.ca’s latest offerings. And, of course, search trends are one thing and actual purchases and usage are another. We’ll keep you updated as we continue to track device use in our consumer research.

For more information on Google Trends, go straight to the source.

To hear the latest about consumer behaviour and e-book reading trends, make sure you’re registered for Technology Forum 2013, where you’ll hear analysis from BookNet, Bowker, BiblioCommons and Kobo.